In this week’s edition of The Context, Terraform Labs loses it all, an SEC bigwig calls it quits, and the SEC lets it go.

[Isn’t That Terra-ble? 👋]

Terraform Labs, creators of the collapsed LUNA token and TerraUSD stablecoin, agreed to a $4.47 billion settlement with the U.S. Securities and Exchange Commission.

What Journalists Said 🧑💻:

Terraform Labs filed for bankruptcy protection in January, so much of this settlement is “unlikely to be paid,” wrote Jonathan Stempel (Reuters). Instead, the settlement maximises returns to defrauded investors while ensuring Terraform—and co-founder Do Kwon (jailed in Montenegro and awaiting possible extradition)—are shut down for good.

Before SBF, “Kwon was widely regarded as crypto’s top villain for nearly dismantling the entire sector,” said MacKenzie Sigalos (CNBC). Kwon’s stablecoin was backed by an algorithm tied to LUNA. “When the algorithm failed in May 2022, it cost investors $40 billion in market value overnight…and contributed to the collapse of hedge fund Three Arrows Capital in June 2022, followed by crypto lenders Voyager Digital, then BlockFi, then Genesis.”

Caretaker CEO Chris Amani, while contending that Terra could have turned things around, admitted defeat, said Andre Beganski (Decrypt). After losing a jury trial to the SEC in April and then acceding to a massive settlement, Terraform will officially close shop after giving ownership to the community and selling off some projects.

PR Perspective 🔎:

“Community” is an overused term in crypto. While many people sincerely believed in the project, some who remain in the Terra ecosystem are no doubt just trying to salvage anything from their investment.

[SEC You Again? 👀]

David Hirsch, chief of the Crypto Asset and Cyber Unit of the SEC’s Division of Enforcement, announced via LinkedIn that he has resigned.

What Journalists Said 🧑💻:

For nearly nine years, “Hirsch was the SEC's crypto enforcer against cryptocurrency exchanges and decentralised finance (DeFi) projects,” wrote Amitoj Singh (CoinDesk). While he had previously acknowledged the agency’s heavy case load, he said “it wasn't done chasing down those it sees as violating securities laws.”

A guy as committed to crypto crackdowns as Hirsch doesn’t just go work for a crypto firm, does he? After Binance published a report he would join trading platform Pump.fun, Hirsch denied it, telling Protos his next role “is not with this or any meme coin/platform.”

“Hirsch’s departure comes at a critical time as the SEC faces increased political scrutiny amid a U.S. election year regarding its approach to crypto regulation,” wrote William M. Peaster (Bankless). Everyone in crypto is watching to see whether that approach will shift.

PR Perspective 🔎:

Imagine the publicity that would come from Hirsch joining a big-name crypto company. Not only would it put a spotlight on the revolving door between regulators and companies—it would also send a message that institutional players see (at least some) crypto as legitimate.

[SEC Change? 👀]

Ethereum incubator ConsenSys, makers of MetaMask 🦊 and Infura, announced the SEC has closed its investigation into the company and Ethereum 2.0.

What Journalists Said 🧑💻:

ConsenSys was caught up in a probe “into Ethereum and entities supporting the protocol,” noted David Canellis (Blockworks). Although that investigation “was expected to be dropped following approval of…spot ether ETFs…the formal notice puts to bed one of crypto’s primary existential threats, at least for now.”

According to ConsenSys, the SEC’s investigation was centered around the idea that post-merge — when Ethereum went from Bitcoin-style proof of work to a proof-of-stake consensus model — ETH might have become a security. That prompted ConsenSys to sue the agency, said Nikhilesh De (CoinDesk).

The legal battle isn’t over, noted Reuters. While ConsenSys founder Joe Lubin sees this as a “significant victory,” he’s pushing the advantage. “Consensys said it will continue its lawsuit in pursuit of a court ruling that the SEC does not have legal authority to regulate the user-controlled software interfaces built on Ethereum.”

PR Perspective 🔎:

The possibility that ETH might me a security has been weighing down the industry for a while. Ethereum ecosystem developers can now focus a bit more on building products and a bit less on defending themselves from regulatory attacks.

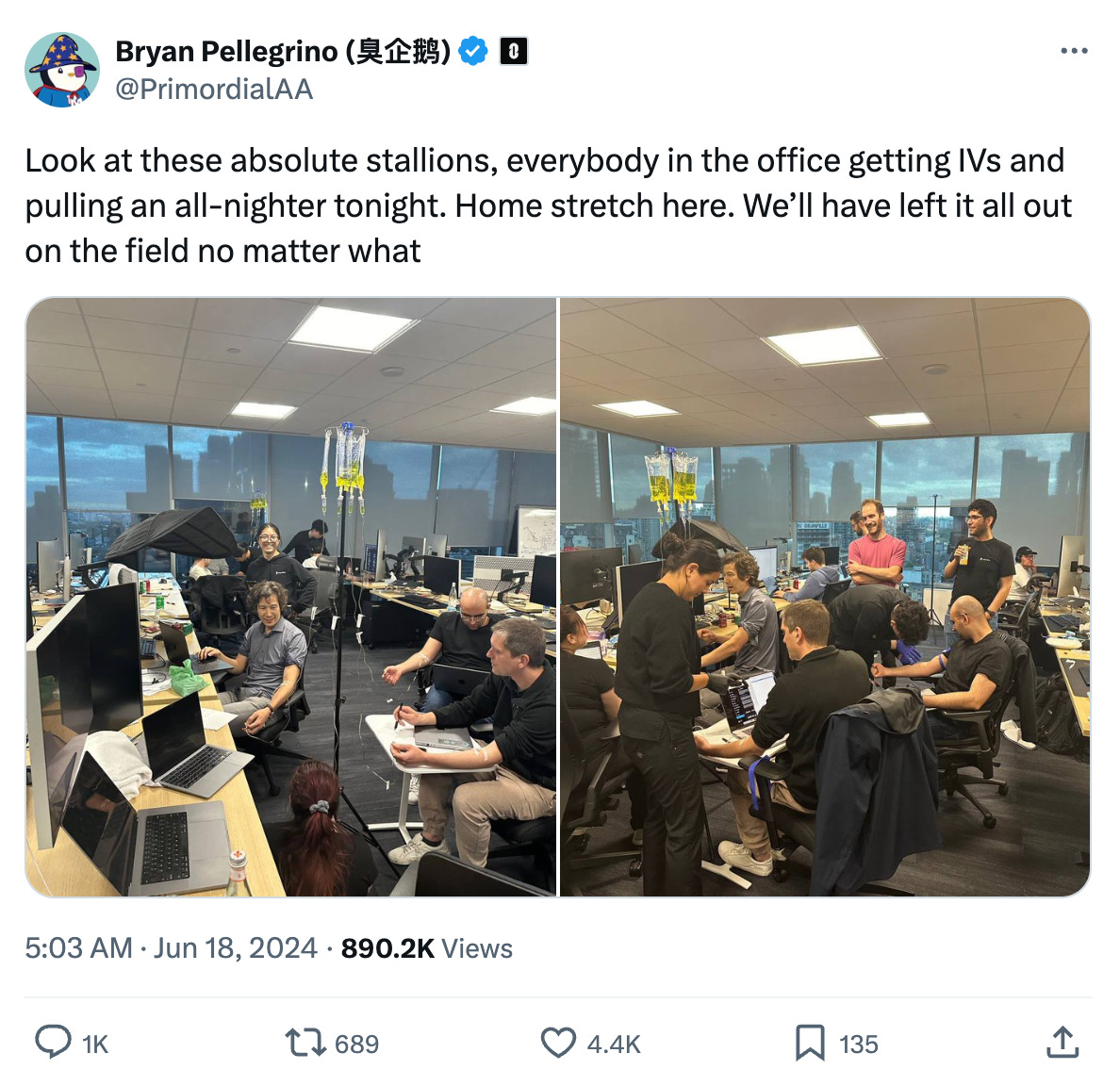

[Tweet Of The Week]

Credit: @PrimordialAA

[DeFi Definitions]

A segment exploring one particular aspect of DeFi. View previous entries here.

This week: ‘’Fractionalisation” by Celina Chu.

Fractionalisation is a key aspect of tokenisation. It involves breaking down digital assets like a Bitcoin or a Non-Fungible Token (NFT) into smaller, manageable parts called tokens or fractions.

Tokenisation and Fractionalisation similarly open up new ways for investors to engage with assets on the blockchain. Tokenisation is a digital representation of a single whole asset, whereas fractionalisation entails dividing one asset into multiple parts that can be held by different owners. Recently, we saw this with Yat Siu, Co-Founder of Animoca Brands. He tokenised a 316-year-old Stradivarius violin in the hopes of eventually fractionalising it, allowing others to buy a claim on it.

In the context of decentralised finance, fractionalisation democratises ownership of high-value assets by allowing investors to own parts of it. Similarly, an expensive NFT can be fractionalised to allow multiple buyers to own a portion of the digital artwork and real estate buyers to own shares in a property.

Fractionalisation promotes inclusivity, liquidity, and utility of digital assets for a broader range of investors.

The usual disclaimer: This newsletter collates the main themes and headlines of the week in DeFi/crypto/metaverse/Web3/NFT land and tries to provide unbiased context. It's aimed at anyone who wants to keep an eye on the space. It's put together by a team at YAP and doesn't contain any promotion of our clients (if one is mentioned, we'll flag that).

The team: Founder Samantha Yap and consulting editor Jeff Benson, Ewan Brewster, Andrew Wickerson, and Emma Murphy. Your feedback is, as always, welcome. Ping us at thecontext@yapglobal.com. Old newsletters can be found here.

This newsletter is prepared by YAP Global, an international P.R. Consultancy focusing on helping cryptocurrency, Decentralised Finance (DeFi) and brands through impactful storytelling. Find out more about us here.